年配層のなかには、「シニアビジネス」という言葉に自分たちが汗水たらして貯めてきた財産を騙し取ろうとする悪質なイメージを持つ人も少なくありません。特殊詐欺など年配層の不安をつく詐欺商法が後を絶たないからです。

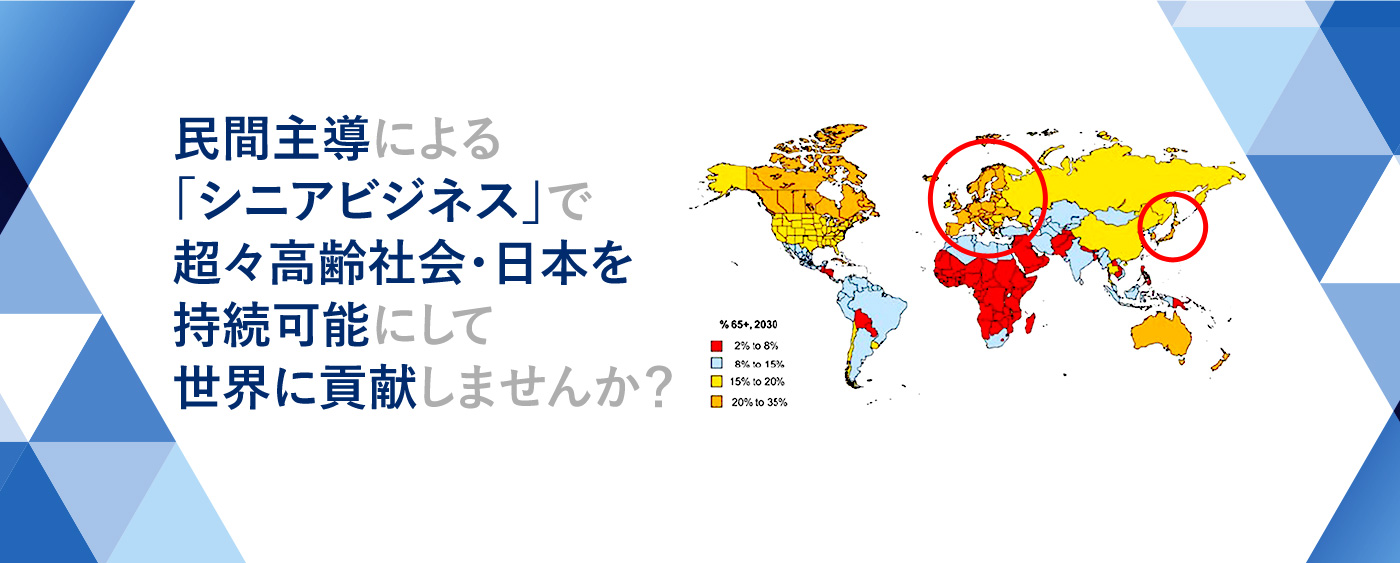

しかし、私が「シニアビジネス」という言葉を使う理由は、まったく別です。それは、超々高齢社会の諸問題の解決は、補助金などの国費投入でなく、健全な収益事業、つまり「ビジネス」で行なうべき、と考えているからです。

つまり、超々高齢社会の課題を、公的助成金や介護保険報酬に依存せず、民間主導の健全な収益事業で解決することがシニアビジネスの本質です。

※“超々高齢社会(ultra-aged society)”とは、高齢化率28%を超える社会を指します(村田裕之による独自の定義)

著書

Book

スマート・エイジング 人生100年時代を生き抜く10の秘訣

成功するシニアビジネスの教科書 「超高齢社会」をビジネスチャン...

親に「もしも」が起きたとき、あなたがすべき20のこと

どうする?親の家の片付け

シニアシフトの衝撃

年を重ねるのが楽しくなる![スマート・エイジング]という生き方

親が70歳を過ぎたら読む本

リタイア・モラトリアム

いくつになっても脳は若返る

団塊・シニアビジネス 7つの発想転換

シニアビジネス「多様性市場」で成功する10の鉄則

Mr.古希 第二の人生の参考書

The Silver Market Phenomenon: Bu...

Mail Magazine

「シニア市場の特徴・シニアの消費行動に関する知見」「超々高齢社会・国際情勢の最新動向」「中高年の健康維持に関する情報」「講演会・セミナーなどのイベント情報」をメールマガジンでお伝えしています。